Financial Services

Payment Processing & Solutions

Equipment Financing

Vehicle Appraisal

Payment Processing & Solutions

DealerShop has teamed up with a cost-reduction firm specializing in credit card processing fees, to provide you with a no-risk solution to remove significant wasted spend from your merchant account without switching processors or changing anything about your accounting system or point-of-sale. Let our proven audit process identify savings opportunities associated with the unnecessary costs from credit card transaction and processing fees.

Lower credit card processing fees without changing processors.

Most businesses are being overcharged within their merchant account. They often believe that there is only one way to achieve lower credit card processing fees: change processors. This is often a mistake. It’s typically best to stay with the processor you already have.

DealerShop and its Partners simplifies your existing merchant account.

Credit card processing fees are complex ON PURPOSE. The industry is made up of numerous banks, card-brands, and processors … and all of them influence the fees businesses pay. To lower these fees, you need extensive expertise, insider knowledge, and mountains of industry benchmark data. DealerShop has you covered. We will optimize your merchant account and fix every error and overcharge … without any need to change processors. And you don’t pay us a dime until we bring that money back to you.

Identifying the problem.

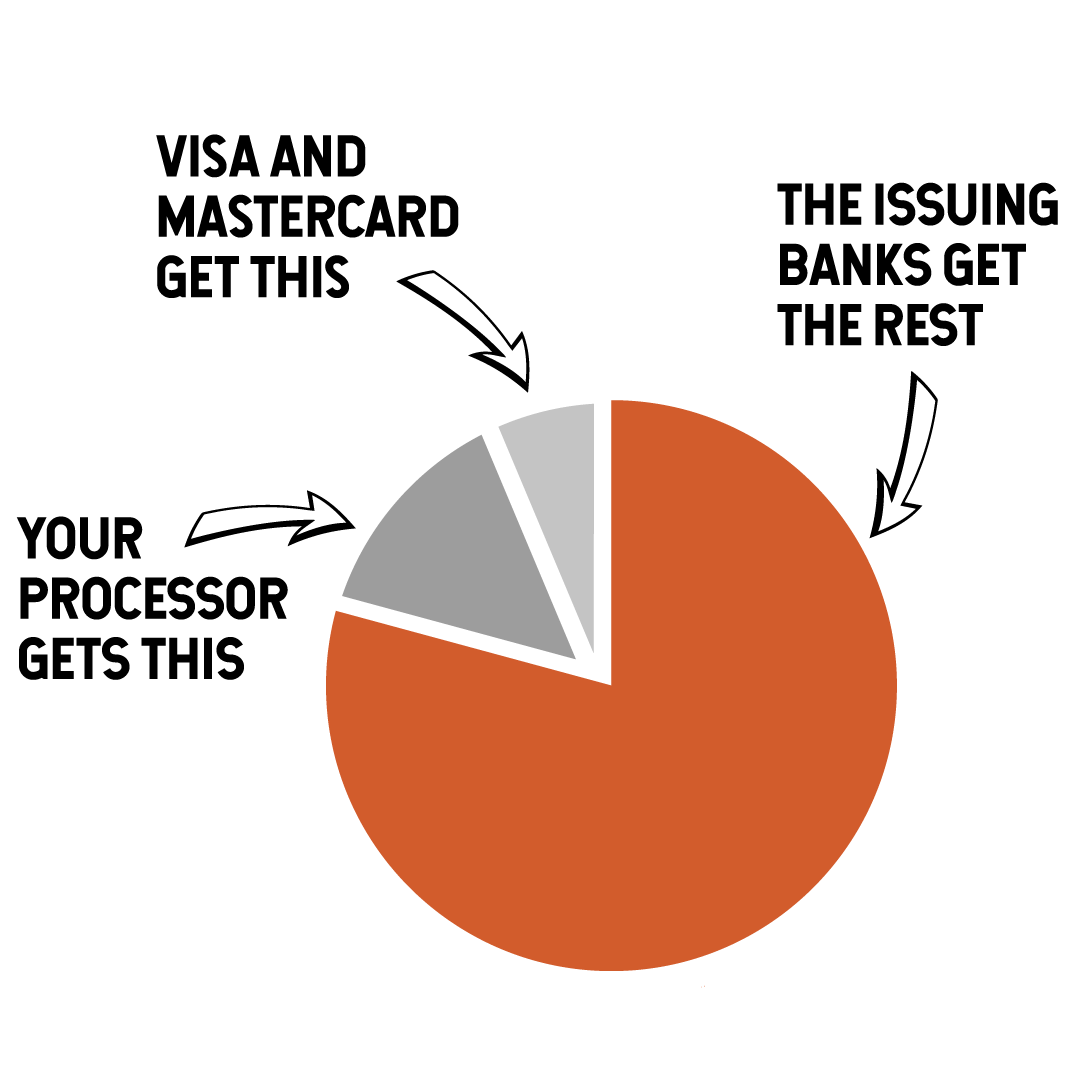

You have very little control over your merchant account credit card processing fees. Yes, you have a direct relationship with your merchant processor. But only a small amount of the credit card processing fees you pay go to that processor. Most go to the bank that issued the credit card … and you have no leverage with that bank. Most of their fees go to the bank that issued the credit card to your customer … and they have no leverage with that bank. These are called INTERCHANGE FEEs. And they can be lowered.

Processing fee optimization.

Many merchants recognize that they’re losing money on credit card processing fees, but they don’t have the expertise to identify where it’s happening or how to fix it. With our proprietary process:

- You get full transparency of your merchant processing fees

- Your account is optimized to the lowest possible rate

- You receive all applicable industry or card-type discounts

- We can even lower your interchange fees

- We do all of the work for you

A Better Way To Accept Payments.

Dealer Pay offers a wide variety of services to keep your business running efficiently. Our dealer-specific solutions cover more than just simple payment processing. We have innovative services to help you manage all facets of your dealership. From sales and accounting, to service and customer retention, Dealer Pay makes for happy employees and loyal customers!

Dealer Specific Solutions.

Our services are designed exclusively for dealerships and tailored to address the unique challenges they face. This means you can trust that our solutions are optimized to be the best possible fit for your dealership’s needs. Learn more at DealerPay.com

DMS Integrations

Our dealer-specific solutions are designed to help your dealership increase sales, profits, and process payments faster and more securely in each department. With DMS Integration, users can search in ‘real time’ for open RO#’s, parts tickets, deal numbers, and more. This integration reduces steps, minimizes errors, and ensures efficient transaction processing. Auto Reconciliation matches transactions to the DMS, highlighting any unmatched items for easy review and daily reports.

Equipment Financing

WHAT WE FINANCE

Automotive and Heavy Duty

- Alignment Systems

- Alignment Racks

- Tire Changers

- Tire Balancers

- Tread Monitors

- Lathes

- Lifts

- Compressor

- Diagnostics

- Workstations

- Lube Reels/Hoses

- Miscellaneous Equipment*

- Software including Professional Services

- Computer Hardware

- Signage Shelving/Racking

- Facility Build-outs

- DMS Systems

- Security monitoring

*Can include Installation, Shipping, and Accessories.

Collision

- Frame Racks

- Measuring Systems

- Welders

- Paint/Spray Booths

Specialty

Large and small-scale facility build-outs that include:

- Sales and Services Technology, Equipment and Solutions

- Dealership Sponsored Programs

- Essential Tool and Equipment

AppraisalPRO – Seamless vAuto Integration for Accurate Trade-In Appraisals

Enhance Your Appraisal Process with Reliable, Real-Time Data

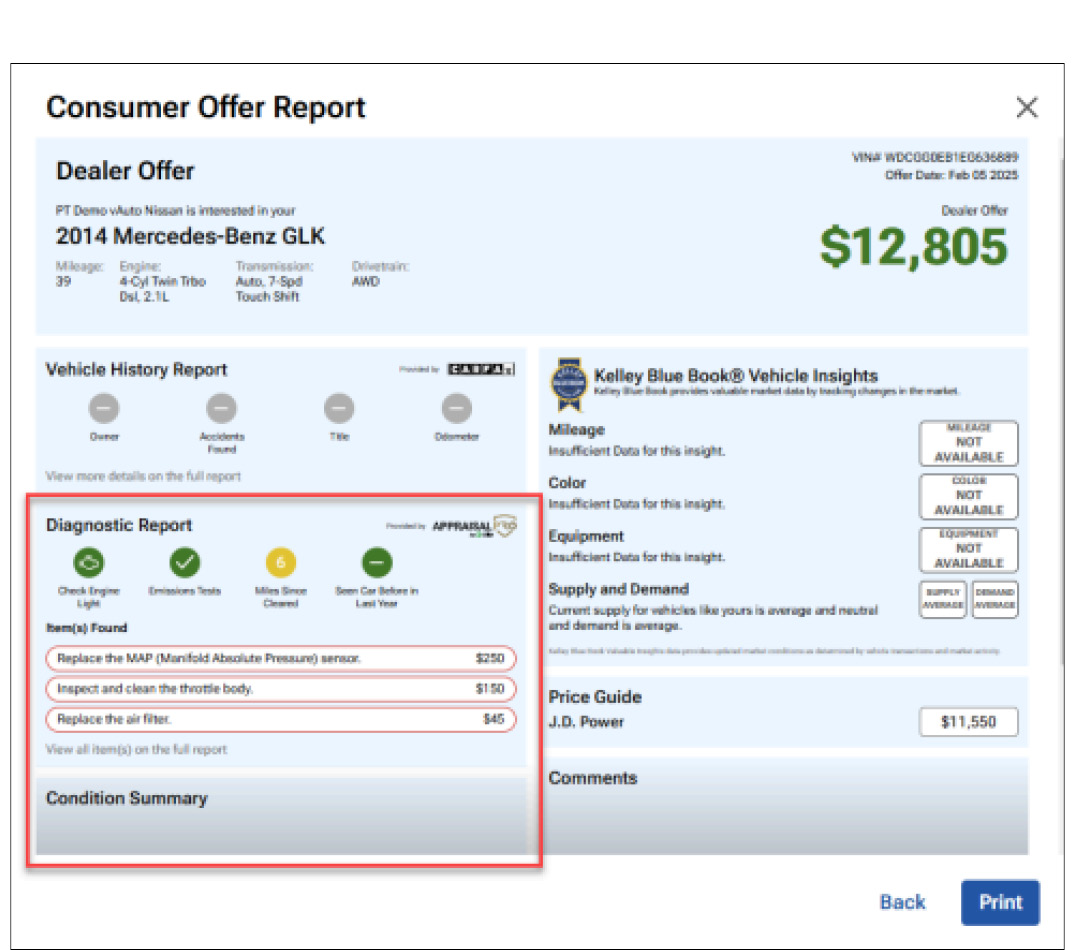

AppraisalPRO simplifies and improves vehicle appraisals by integrating directly with vAuto. With data from over 135 million vehicle scans and analysis of 5 million unique vehicles, AppraisalPRO provides accurate, expert-verified repair estimates, allowing dealerships to confidently determine trade-in values within their existing vAuto workflow.

Why Dealerships Choose AppraisalPRO

- Seamless vAuto Integration – Automatically sync appraisal data with vAuto, eliminating manual entry and ensuring accuracy.

- AI-Powered Accuracy – Uses advanced machine learning models based on millions of real-world vehicle diagnostic

- Expert-Verified Estimates – Repair cost estimates validated by ASE-certified master technicians, ensuring reliability.

- Comprehensive Diagnostic Coverage – Extensive coverage of diagnostic trouble codes (DTCs) for precise vehicle condition assessments.

- Optimized Trade-In Valuation – Clearly identify necessary repairs and apply your dealership’s custom labor rates for informed valuation

How AppraisalPRO Works

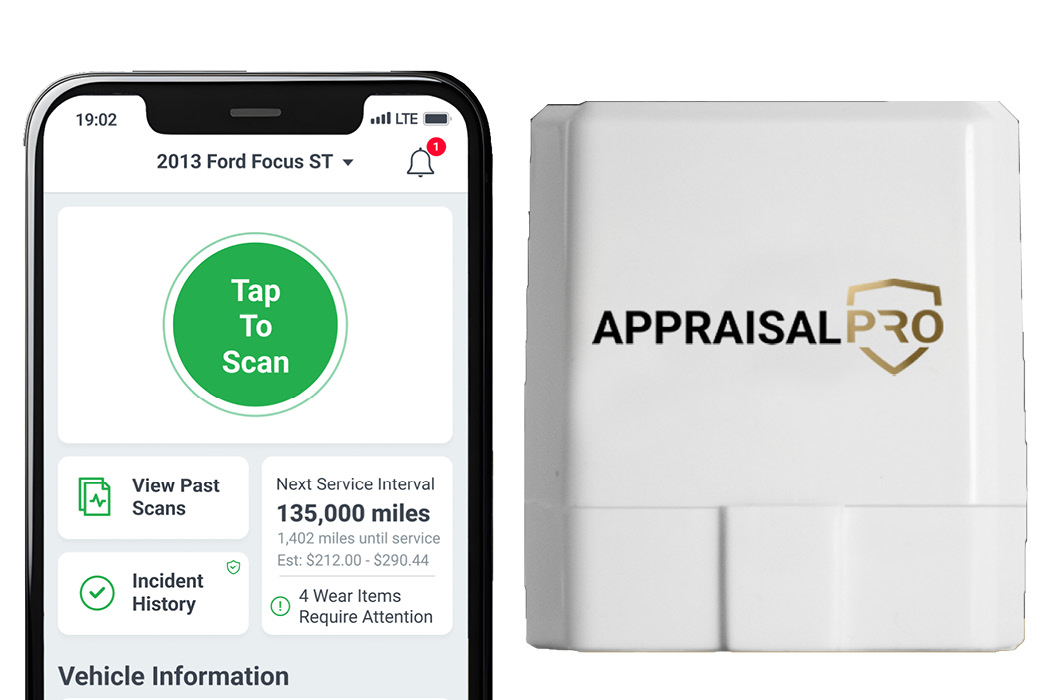

1. Plug & Scan – Connect the AppraisalPRO OBD2 sensor to the vehicle.

2. Instant Diagnostics – Receive real-time data through the AppraisalPRO mobile app via Bluetooth connection.

3. Automatic Data Sync – Seamlessly integrate appraisal results into your existing vAuto system.

4. Confident Valuations – Set competitive yet profitable trade-in prices based on vehicle-specific repair costs and condition.

Discover how AppraisalPRO integrated with vAuto can streamline your trade-in appraisals and boost dealership profitability.

[email protected] | 833.332.5001